Average Cost For Independent Living 2025

The cost of senior living on their own can vary a lot depending on where it is located, what amenities it has, and how many services it offers. Here is a list of the most common costs and things to think about:

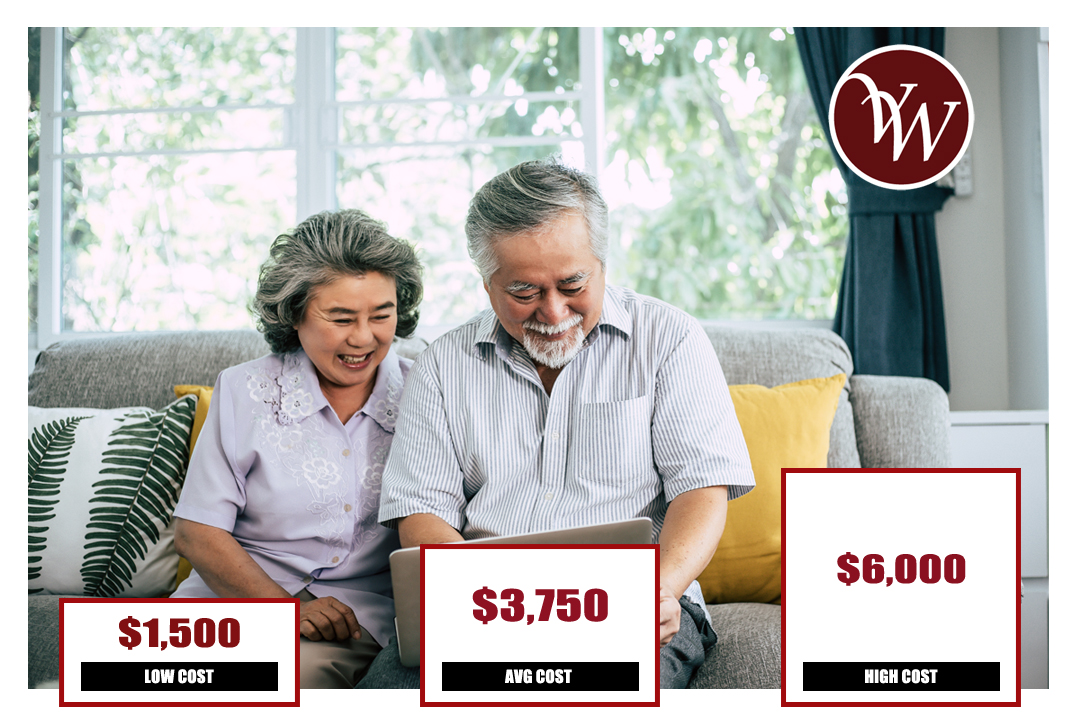

1. Average costs across the country (2025 estimate)

Costs every month: $2,000 to $4,000.

Costs per year: $24,000 to $48,000.

2. The price in Arizona

A month in this state makes about $2,200 to $4,500.

Popular places to retire, like Scottsdale or Sedona, may be on the more expensive side because of high demand and high-end options.

In general, it costs less to live in smaller cities like Yuma or Sierra Vista.

3. Things that affect prices

Location: Independent living communities that are in cities with higher cost of living tend to be more expensive.

Amenities: It costs more to live in a luxury community with services like fitness centers, pools, gourmet restaurants, and concierge services.

Size of the Apartment: Studio apartments are less expensive than one- or two-bedroom apartments.

Extra Fees: Some communities have entrance fees or different levels of prices for extra services like housekeeping, meal plans, and transportation.

4. Common things included

Utility bills and rent.

Simple repairs and landscaping.

Social events and activities in the community.

Use of facilities like gyms, libraries, and community rooms.

5. Financial help

Most of the time, Medicaid and Medicare do not pay for independent living because it does not include medical care.

Money saved for retirement, pensions, or long-term care insurance can help seniors pay for these things.

Veterans and their spouses may be able to get benefits from the VA that can help pay for some costs.

How To Find The Best Independent Living Community

It might seem hard at first, but it’s getting easier than ever in 2025 to find a retirement community that fits your personality and way of life. Lots of new retirement communities are being built very quickly all over the place. Though, we know it can be hard to pick the right retirement home. That’s why we made this guide to show you what to look for.

Check the temperature of the place. People think that the weather is one of the most important things to consider when picking a retirement community. Find out about the place you’re going to make sure you can handle changing weather. It gets as hot as 86.4°F sometimes and as cold as 57.5°F other times in Peoria, Arizona. The average temperature there is about 71.95°F.

Feel the vibe. Each neighborhood will have its own feel or personality. Talking to the people who live there is one of the best ways to get a feel for the area. This will also help you get to know the people who might live next door. You could also use this as an opportunity to ask the facility director about the services and activities they provide. Vista Winds has a full monthly calendar of fun things to do, such as live entertainment, movies in our state-of-the-art theater, and more.

Prepare for medical needs in the future. As you age, your health should be the most important thing to you. In Peoria, most neighborhoods have a lot of good things about them, but not all of them can give you the medical care you need. Make sure that all of your medical needs will be met in the future before moving to a new area. This is important even if your health gets worse. Vista Winds has retirement communities for almost every stage of retirement. There are communities for independent living, assisted living, and memory care, and caretakers are on duty 24 hours a day.

Figure out your budget. You need to pick a retirement community that doesn’t cost too much. That’s a lot of hard work to save for retirement. You want to make sure that your savings can cover the costs of living in a retirement community. One way to find out might be to get help from a professional financial planner. In some communities, the monthly fees will go up every year. Before you book, make sure you know how often and by how much the charges change every year.

Write down a list. You can remember what kinds of questions you should ask retirement communities if you have a list. Each type of retirement community will have its own checklist that you will need based on the level of care you need. You can get our help with your own independent living, assisted living, or memory care checklists here.

Check out the list of things to do. Almost every neighborhood will have an activity calendar that shows what’s going to happen each day of the month. Check to see if the activities are ones that you’d like. In most places, you can do things like tennis, golf, and swimming. Keeping busy with activities is a great way to stay healthy and fit. Vista Winds has a lot of things to do, like golf, swimming, live entertainment, and more.

Follow the rules. Most places will have rules and regulations that people who live there must follow. Like, some retirement homes don’t let pets live there. Some places may have rules about smoking cigarettes or cooking food on a grill outside. You should look into the facility you want to use to see what rules they might have and see if they fit with the way you live. Vista Winds does allow pets, and the rules are fair for everyone to follow.

Peace of mind and safety. Most places have caregivers on duty 24 hours a day, seven days a week to make sure that residents are safe and healthy. Some places, like Vista Winds, also have gated entrances for your safety and privacy, and there are caregivers on duty 24 hours a day in case of an emergency. We even clean the apartments for free twice a month and offer free laundry facilities.

Tax rates in your area. It’s not always easy to pay taxes in some places. When you’re thinking about investing in a retirement community, the tax rates in your area are something you should think about. It can be hard to pay these taxes. Talk to the owner or director of the facility to find out what kind of taxes or extra yearly fees you can expect.

Acknowledging the deal. You should know what to expect from the community and the community should know what to expect from you before you sign the lease. Some retirement communities have rules about how you can decorate your home, park your car, and other things. If you’ve never lived in one before, this may come as a surprise. You will be told all of the rules up front by Vista Winds so that you know what to expect before you move in.

“Know what your financing options are.”That is possible for seniors who want to buy the best retirement community if they pay cash. If that’s not the case, you should know what your money options are. This could include home loan taxes.”

Pros and cons. Make a list of the pros and cons of each retirement home to help you decide which one to choose. This will help you make your choice: write down what you liked and what you didn’t like. This way, you can find the facility that fits your personality and way of life the best.

[/vc_column_text]Vista Winds Is An Upscale Retirement Community Located In Peoria, Arizona

If you are doing research about retirement communities in Peoria, Arizona, Vista Winds Retirement Home should definitely be on your list. Vista Winds offers retirement living at its finest. We have a rich calendar of activities, meals prepared by a Chef and caregivers on staff 24 hours a day for your health and safety. We offer award winning independent living, assisted living and memory care services. Come tour our community to see how we are a step above the rest and how easy it is to Make Yourself at Home! Vista Winds is surrounded by amazing views and our resort style property will be sure to impress!

More Articles About Retirement

- How To Find A Retirement Community In Peoria, Arizona

- Easy Crafts For Seniors With Dementia

- Top 8 Low Stress Jobs After Retirement

- Can I Retire At 60 With 500K

- 55 Funny And Inspirational Quotes About Aging

- Retiring In Arizona Pros And Cons

- Cost Of Assisted Living In Arizona

- Independent Living Vs Assisted Living